Our purpose

The EU Tax Observatory conducts innovative research on taxation, contributes to a democratic and inclusive debate on the future of taxation, and fosters a dialogue between the scientific community, civil society, and policymakers in the European Union and worldwide.

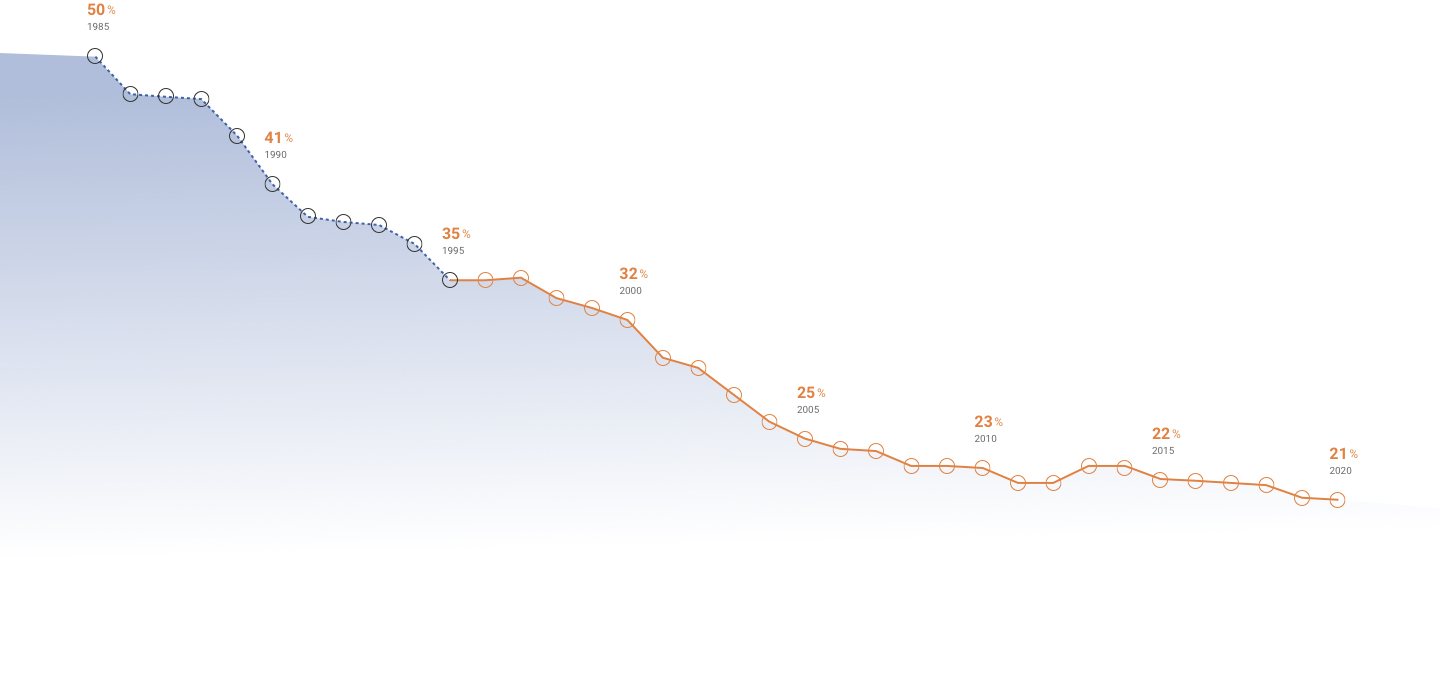

Average statutory corporate

income tax rate in the European Union

The average corporate income tax rate in the European Union has been more than halved since 1980, according to statistics compiled by the OECD and the European Commission

Recent publications

29.08.2025

Tax Progressivity and Inequality in Brazil: Evidence from Integrated Administrative Data

The paper uses population-wide administrative micro-data to provide new estimates of income inequality and effective tax rates by income groups in Brazil, capturing all income and all tax payments.

11.12.2025

Wealth taxes and high-net-worth individuals in Europe: Five Lessons for the Twenty-First Century

This brief reviews the history of net wealth taxes and comes up with five lessons for modern approaches to effectively taxing high-net-worth individuals.

18.12.2025

Did the Tax Cuts and Jobs Act Reduce Profit Shifting by US Multinational Companies?

The 2017 Tax Cut and Jobs Act lowered the US corporate tax rate and introduced provisions to curb profit shifting. The paper combines survey data, tax data, and firm financial statements to study the evolution of the geographical allocation of US firms’ profits after the reform.

Our news

04.12.2025

Press Release: How profit shifting cuts into employee profit-sharing

Paris, December 4, 2025 - A new study by the European Tax Observatory, based on previously unpublished confidential data, shows that the 314 largest French multinationals shift more than €10 billion in profits out of France each year.

29.08.2025

Press Release: Unprecedented Study Provides New Picture of Inequality and Taxes Paid in Brazil

28 August 2025 - A groundbreaking study led by a group of Brazilian and international economists reveals unprecedented findings reshaping our understanding of Brazil’s inequality and tax system.

16.05.2025

Press Release: EU Tax Observatory Brought Together Leading Policymakers and Experts to Discuss the Future of EU Tax Policies

Paris, 16 May — Earlier this week, the EU Tax Observatory hosted its annual flagship event in Brussels. The event brought together leading voices in European taxation to explore the future of corporate transparency, global tax fairness, and the role of enforcement in a fast-changing world.

EUTO in the media

17.12.2025

Le Monde

The idea of a European sclerosis in the face of a supposed American Eldorado is not based on much

More leisure, better health outcomes, greater equality, and lower carbon emissions, all with overall comparable productivity: Europeans can be proud of their model.

17.12.2025

Libération

Mercosur and pesticides: the European Commission’s misleading response

To address the concerns of farmers and environmentalists, the Commission proposes stricter controls on pesticide residues in imported products. A strategy doomed to fail, according to economist Carl Gaigné and researcher Mathieu Parenti.

11.12.2025

Politico

Billionaire tax won’t stop innovation in EU, insists economist Zucman

A minimum tax on the EU's richest individuals will not discourage innovators and start-up founders from investing in the bloc, prominent economist Gabriel Zucman told POLITICO.

Our Tools

To widen access to knowledge, the EU Tax Observatory provides interactive tools, including a simulator of the tax deficit of multinational companies, and an explorer of country-by-country data on the activities of multinationals firms.

Our events

Paris School of Economics, 48 Boulevard Jourdan 75014 03.02.2026

From Secrecy to Transparency: The End of Hidden Wealth?

Exploring how global tax reforms and transparency tools impact offshore tax evasion and financial secrecy worldwide.

Paris School of Economics, 48 Boulevard Jourdan 75014 04.06.2026

World Inequality Conference 2026

The World Inequality Lab is organizing the third edition of the World Inequality Conference, to be held at the Paris School of Economics on June 4-5, 2026.

Join Us

Please contact us for further information.

Newsletter

Subscribe